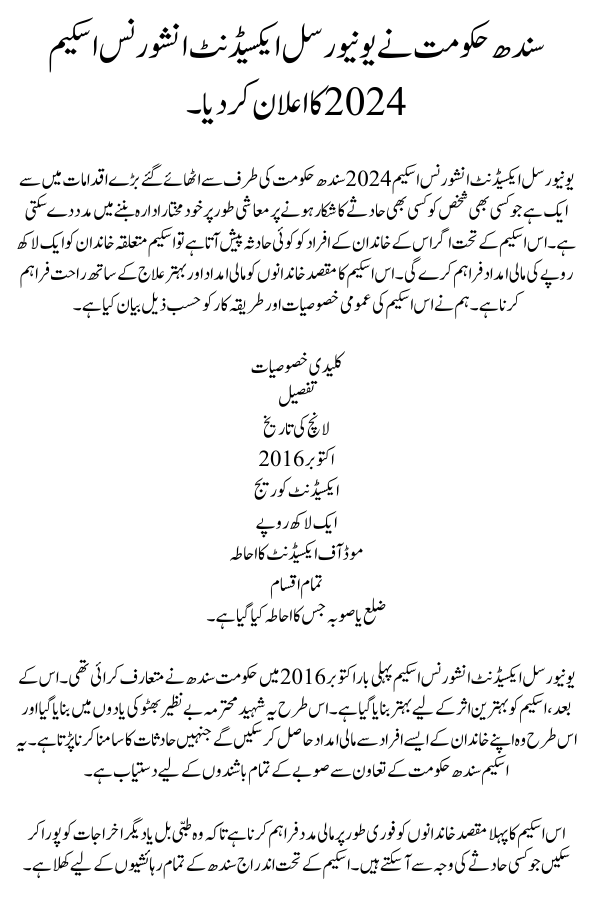

Sindh govt unveils universal accident insurance scheme

The Universal Accident Insurance Scheme 2024 is one of the major initiatives taken by the Sindh Government which can help a person in becoming an economically independent entity if any accidents befall them. Under this scheme, if any accident befals its family members then scheme will provide 1 lakh rupees of financial aid to the respective family. This scheme aims to provide relief to the families with financial assistance and improved treatment. We have elaborated the general features and procedure of this scheme as follows.

- Key Features

- Description

- Launch Date

- October 2016

- Accident Coverage

- One lakh rupees

- Mode of Accident Covered

- All types

READ MORE:Apni Chhat Apna Ghar Scheme Online Registration

District or Province Covered

The Universal Accident Insurance Scheme was the first time introduced in October 2016 by the Sindh Government. After that, the scheme has been improvised to the best effect. Thus, it was made in the memories of the martyr Ms. Benazir Bhutto, and thus they will be able to get financial assistance from their family members who have to face accidents. This scheme is available for all the residents of the province, with the support of the Sindh Government.

The first aim of this scheme is to provide instant financial support to the families so that they can meet the medical bill or other expenses which may come up due to an accident. Registration under the scheme is open to all residents of Sindh.

READ MORE:Double Payment 21000 for Student

Accidents Covered by the Scheme.

This scheme covers a wide array of accidents which may occur in the life of a common man, including the following:

- Road Accident

- Electrocution

- Fire Accidents

- Drowning

- Suicide

- Murder

- Railway Accident

- Industrial Accident

- Steam Boiler Explosion Accident

- Battery Explosion Accident

- Target killings

- Bomb blasts and detonations

- Road, train, or air accidents

- Fires and burns

- Collapse of any building or drowning

- Attack by wild animals

Importance of Universal Accident Insurance Scheme

This project by the Sindh Government reflects a lot of concern towards public safety and well-being as a scheme. Accidents can come about at any moment, and financing security would bring families immense solace. All those affected families can be shielded so that they are not rendered helpless or in distress with an offer of up to 1 lakh rupees by the state government.

How to Benefit from This Scheme

All citizens of Sindh will have to get themselves registered if they want to avail themselves of the Universal Accident Insurance Scheme. With their registration, in case of an accident, the government will provide them with financial assistance without any delay. It is all very simple and can be done even online or by visiting local government offices. How to do it

- Ensure you are a resident of Sindh and keep some document related to your residence.

- Proceed to the download of the registration form on the official website of Sindh Government

- Fill in the registration form with personal details, and your address contact number

- Submit the registration form, and then they will confirm back to you that you are eligible.

READ MORE:Gold Prices in Pakistan

Conclusion

The Universal Accident Insurance Scheme 2024 will safeguard families in terms of the well-being incurred from an accident. It covers a broad range of accidents such as terrorism, road incidents, and industrial accidents. Thus, the scheme provides much-needed financial support in the aftermath of an accident. Active steps are being taken by the Sindh Government to make the facility reach to the citizens so that people can get access to this facility conveniently by promoting registration. You can save your family members today and prepare monetary assistance in case of an accident with the immediate impact of your registration done today.

READ MORE:Farming Project of Agricultural

FAQs

Who is eligible to apply under the scheme?

This scheme can be claimed by permanent residents of Sindh provided they carry some proof of residency documents.

What types of accidents are covered?

It covers all kinds of road, air, and train accidents as well as terrorism cases, fires, collapse of buildings, and attacks by wild animals.

How much?

The compensation amount for the victim’s family due to the accident is up to 1 lakh.