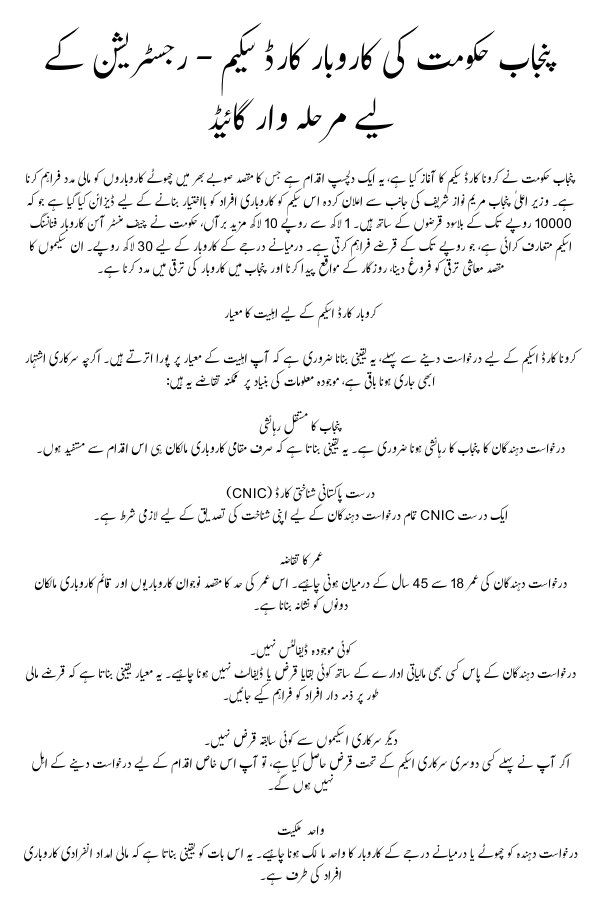

Punjab Government’s Karobar Card Scheme

The Punjab government has launched the Karobar Card Scheme, an exciting initiative aimed at providing financial support to small businesses across the province. This scheme, announced by Punjab Chief Minister Maryam Nawaz Sharif, is designed to empower entrepreneurs with interest-free loans ranging from Rs. 1 lakh to Rs. 10 lakh. Additionally, the government has introduced the Chief Minister Asan Karobar Financing Scheme, which offers loans of up to Rs. 30 lakh for medium-sized businesses. Together, these schemes aim to promote economic growth, create job opportunities, and support business development in Punjab.

Eligibility Criteria for the Karobar Card Scheme

Before applying for the Karobar Card it is important to ensure that you meet the eligibility criteria. Although the official advertisement has yet to be released, here are the likely requirements based on current information:

Permanent Resident of Punjab

Applicants must be residents of Punjab. This ensures that only local business owners benefit from this initiative.

Valid Pakistani Identity Card (CNIC)

A valid CNIC is a mandatory requirement for all applicants to verify their identity.

Age Requirement

Applicants should be between 18 and 45 years of age. This age range is intended to target both young entrepreneurs and established business owners.

No Existing Defaults

Applicants must not have any outstanding debts or defaults with any financial institutions. This criterion ensures that the loans are provided to financially responsible individuals.

No Previous Loans from Other Government Schemes

If you have previously received a loan under any other government scheme, you will be ineligible to apply for this particular initiative.

Sole Proprietorship

The applicant must be the sole proprietor of a small or medium-sized business. This ensures that the financial assistance is directed towards individual entrepreneurs.

When Will Registration Begin?

As of now, the Punjab government has not officially announced the registration date for the Karobar Card However, it is expected that the registration process will begin in January 2025. Once registration is completed, the disbursement of loans is anticipated to start approximately one month later.

How to Apply for the Karobar Card Scheme: Step-by-Step Guide

apply for the Karobar Card

Stay Updated on Announcements

First, keep an eye on official government sources like the Punjab government’s website and social media channels for the official launch date and registration details. These platforms will provide you with the latest updates.

2Verify Your Eligibility

Before you begin the registration process, ensure that you meet the eligibility criteria listed above. This step is essential to avoid any delays or rejections in your application.

Gather Required Documents

Prepare all the necessary documents for your application. Typically, you will need:

- A valid CNIC (National Identity Card)

- Proof of residency in Punjab (e.g., utility bills or rent agreements)

- Documents proving your business ownership, such as registration documents or tax records

Register Online

Once the registration portal is live, visit the official Punjab government website (to be announced). Fill out the online application form with accurate details about your business and personal information. Double-check the details to avoid errors that could delay your application.

Await Application Review and Approval

After submitting your application, it will undergo a review process. The Punjab government will verify the information you have provided and check your eligibility. This step may take some time, so be patient.

Loan Disbursement

Once your application is approved, you will be notified about your loan amount. The loan will be disbursed according to the scheme’s terms and conditions. This financial assistance will help you grow or sustain your business.

Conclusion

The Karobar Card launched by the Punjab government is a fantastic initiative that will greatly benefit small and medium-sized business owners. By providing interest-free loans, the government is helping to remove some of the financial hurdles that prevent many businesses from growing. With the Chief Minister Asan Karobar Financing Scheme offering loans of up to Rs. 30 lakh, medium-sized businesses also have a chance to thrive. If you’re an entrepreneur in Punjab, don’t miss out on this transformative opportunity. Stay tuned for further updates and start preparing for the registration process.